…a significant number of funds have been created that are being led by General Partners who have little Venture Capital experience. These partners come from other sectors (private equity, investment banking or family offices)…

The Spanish scene is so small that an increase of funds will decrease the chances of a great project dying because of no investor interest. The potential success of local projects will only encourage other entrepreneurs to begin their own companies that, at the same time, will increase the chances of investors finding new and more varied startups with great potential. This, in the long run, will translate into a greater number of exits.

Another consequence of having more capital (and VCs) available than ever before, is the fact that the best entrepreneurs can now choose between investors, something that was unthinkable just five years ago. This is a critical issue…

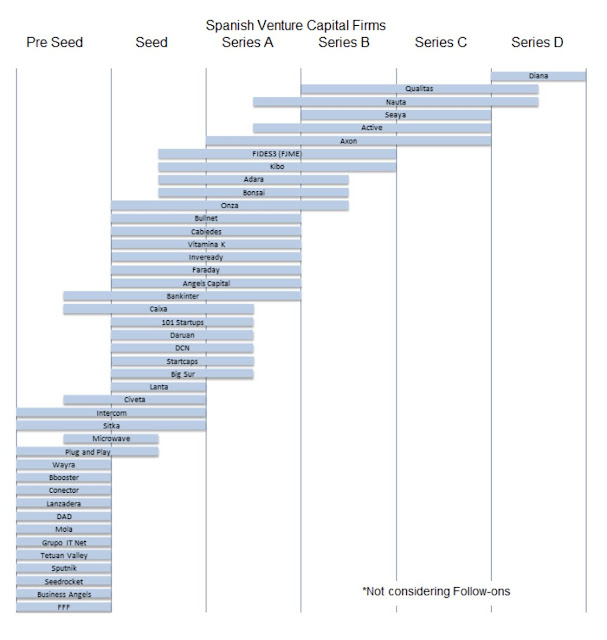

in Spain it’s currently possible to raise a Series C round, to the point that this might even be achievable with only Spanish capital. This doesn’t mean that this is the case or the norm, as most local startups who have reached that level (Series C and beyond) tend to raise capital from US or northern European investors, which might help explain why valuations converge at the Seres C stage. For these very same reasons, the value captured by pre Series C investors can be huge if they sell after Series C.