“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

~ Roy Amara

Origen:

It was roughly a decade ago when the giants of the oil age were surpassed by silicon stars, Apple and the like, as the largest firms in the world. So too a decade-or-so since deep-learning and data-meets compute started to become useful. More than a decade since the smartphone became the ubiquitous computing device giving most of us an internet-connected super computer in our pocket. Beyond that, it’s 6-7 years since solar generated electricity started to become consistently cheaper than fossil generated electricity. And the same time since the cost of sequencing a human genome fell below $1000. And it is just shy of a decade from the first one-off successful trials of gene therapies. There are now roughly a dozen approved therapies based on CRISPR or CAR-T, and the drumbeat is speeding up.

…

How short is the long run?

So with Amara’s lens, do we consider this – the data and compute strategy – a 14 year, ten year, four year or two year trend?

Let’s go back to the data. Over that ten-ish year period, sequencing the genome has become 10 times cheaper. Solar generated electricity has fallen in price by a factor of four. The cost of lithium ion batteries have dropped by about 80%. And all with attendant impacts on not just the tech industry, but the energy, transport and healthcare sectors too.

So when we take stock at the beginning of 2024, it might not be unreasonable to assertion that we’re into the second half of Amara’s picture, the other side of the inflection.

And if we are, we shouldn’t be surprised to see rapid deployments of technologies into our economies.

In many cases, we’re passed both the science and engineering hurdles, into the market and commercialisation ones.

Why do things suddenly go quickly?

Why can this acceleration take place? It’s about feedback loops. In the case of the new technologies, positive feedback loops spin up and with them rapid improvement in price or performance.

Technology transitions take a few years, fewer than you think. Where markets are in the long-run part of Amara’s assertion, the other side of the inflection, we could well be in the steepest part of the adoption curve.

But in truth what do we really know?

What can we really forecast at times like this? I like Brad DeLong’s phrasing: “we are in Knightian uncertainty rather than Bayesian risk.”

Knightian uncertainty deals with the unknown and unknowable, where probabilities can’t be meaningfully assigned.

Bayesian risk relies on knowable and known probabilities which can be updated with new information.

A world of unknowability requires different strategies, from scenario thinking, portfolio approaches, flexibility and adaptability, resilience, judgement and preparedness. These approaches help deal with uncertainty and those situations where it is too expensive or inaccurate to constantly reappraise where we stand.

But this is indeed where we stand. Perhaps President Kennedy said it best when he addressed a crowd at Rice University some 61 years ago:

The greater our knowledge increases, the greater our ignorance unfolds.

Three major trends are important elements in this complex process of systems change.

The first is the growing evidence that climate change, through hotter temperatures, extreme weather and signs of hitting tipping points, is well underway. This will have substantial impacts on the risks people and nations face and how they respond.

Secondly, global demographics are getting complicated. Many nations are aging and shrinking and others, particularly in South Asia and Africa are getting younger and larger. This speaks to political and economic challenges. And different trade-offs from exponential technologies, especially AI.

Third, geoeconomics has shifted. Uncertainty is back, baby. Money is (and likely to continue to be) more expensive than it has been for the past decade. Geopolitics is breeding a new geoeconomics. The exponential transition is creating not just new opportunities but vast swathes of stranded assets (both natural ones, oil in the ground that will soon serve no economic purpose; and human-created ones like firms, business models and infrastructure that will be leapfrogged or disrupted by the next).

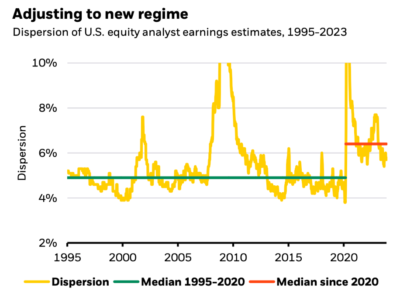

The chart from Blackrock below summarises this new age of uncertainty. Equity analysts are less in concordance than that have been for 25 years. It is all a bit WTF (or as JFK might have said “unfolding ignorance”.)