In summary.

- Nearly everything’s about software (except handbags and champagne)

- Scale is a commodity. Competition is about entrepreneurship

- Talent is flocking to startups. And startups are built from anywhere

- More than ever, corporates would benefit from partnering with startups, and strong ties with entrepreneurial ecosystems

Origin: pdf report

- The tech boom: tech companies globally have reached a combined value of $35 trillion, of which $24 trillion (68%) from the USA.

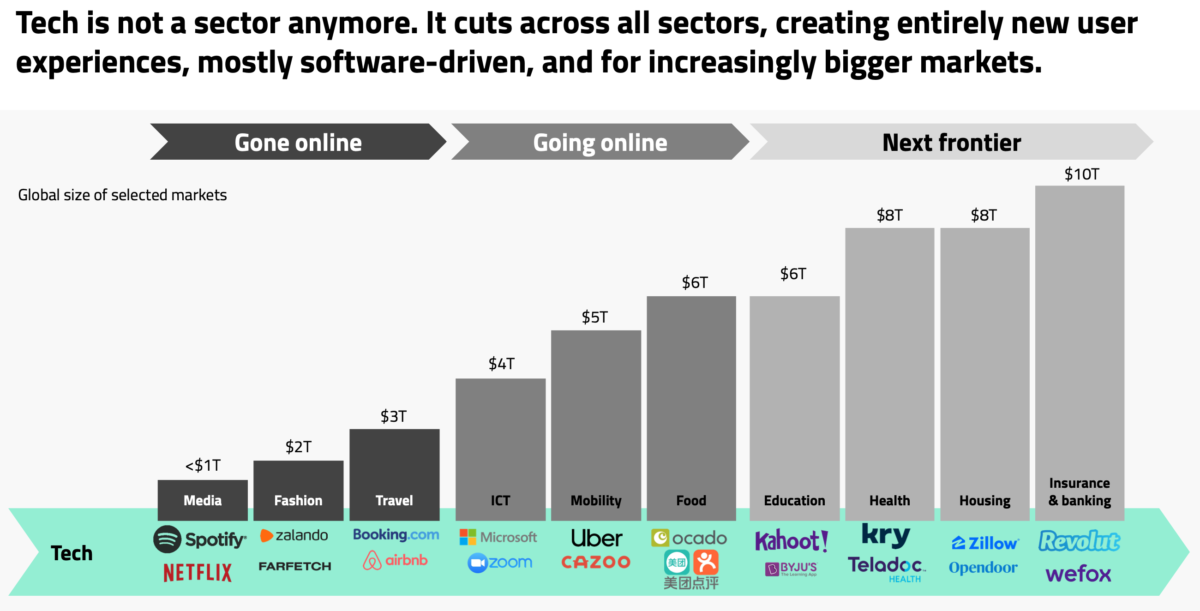

- Today, technology equities are eclipsing all others … but back in 1900 rail was the biggest sector. Later, airlines. These were also “tech”.

- 80% of adults are online. They’re not only spending money online but also earning income online. This means that even work itself is open to innovation.

- Europe’s big corporate R&D budgets are concentrated around pharma, automotive and telecom. The USA dominates internet, software and electronic hardware.

- Concentration, yes, but not monopolies. Mortality risk of companies has increased … companies in the S&P 500 keep getting younger. Economic dynamism is up.

- The clearest sign that economic dynamism is up: younger cohorts of startups are creating just as much value as older ones ‒ if not more.

- Global venture capital is crushing previous records in 2021. In Europe, the growth in venture capital is even more pronounced.

- Following Covid-19, corporates are accelerating their digital processes. The degree of spending on IT varies hugely between sectors.

- Internal innovation is important, but today’s most successful companies have undergone transformations through external innovation, too.

- VC investment by corporates is on track to reach an all time high in 2021. But corporate’s share of total VC investment is the lowest since nearly a decade, decline is mostly at late stages.