The world’s largest tech companies have started to clamour for regulation in this hugely under-regulated sector.

Origen: 💭 The real reason tech companies want regulation – Exponential View

The tech industry got a speed-up with the Intel 4004 processor, launched in 1972. This was contemporaneous with American right-leaning economists launching a sustained attack on the regulatory state. The growth of the early PC industry in the late seventies and early eighties coincided with the supply-side thinking of Reagan and Thatcher. As an industry, it has enjoyed the fruits of limited government oversight. But tech was a nuclear reactor running hot because we had not only taken the control rods out, we had pooh-poohed them as antithetical to the purpose of the reactor.

Of course, there is a but. There are three buts, actually.

If you know you are going to be pwned, you may as well do it to yourself. … A smart strategy would be to help facilitate the debate, which is what Microsoft and, to a lesser extent, Google is doing. …

The second but is that regulation favours large companies. Regulation is complicated. Dealing with it means dealing with lawyers, hiring compliance people, changing your product roadmap, building new code. Regulation raises barriers to entry. The most regulated industries, finance and health, have seen the deep consolidation and weak flow of new entrants for decades. …

The technology companies are not talking about the other thing that needs to be regulated: large, AI-driven, platform-network companies. …

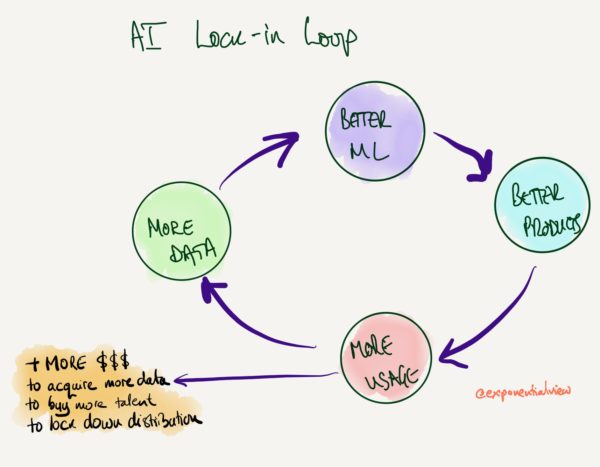

In the exponential age, the engine at the heart of our leading companies, is the perpetual motion machine, the self-blowing windmill, of artificial intelligence.

It isn’t simply data network effects, which most manifestly power dominance in the search-ad-surveillance business of Facebook and Google. It is the traditional network effect of platforms, the strength of the partner ecosystem they can build, which strengthens their platforms too.

The bigger these platforms get, the bigger they can get. Like some fearsome creature at the boss level of a coin-op arcade game.

…

The concentration of big tech goes hand in hand with their financialisation. …

The playbook of the digital firm, riding high on these network effects, is to create a monopoly. As Peter Thiel says in Zero to One, tech pioneers should set out to create a

“monopoly” […] the kind of company that’s so good at what it does that no other firm can offer a close substitute. Google is a good example of a company that went from 0 to 1.

These monopolies have been good for the consumer, driving down prices and driving up product quality. … And because network effects are often pretty good for consumers, courtesy of Metcalfe’s Law, these tech giants confuse regulators which look for consumer harm to justify taking action against monopolists. The behemoths repeatedly lie to themselves by denying their monopoly status.

But Thiel’s notion of monopoly also has a specific requirement about the creative dynamic that brilliant tech firms should live in.

In a static world, a monopolist is just a rent collector […] But the world we live in is dynamic: it’s possible to invent new and better things. Creative monopolists give customers more choices by adding entirely new categories of abundance to the world.

The question is what steps will these large firms take to ensure the world isn’t dynamic? And to what extent will the AI perpetual motion machine keep them ahead?

Raising regulatory costs deters competitors.

AI’s lock-in loop advantages incumbents.

And the only answer then might be government, the state, the regulator, unfashionable though it may be to say. And knowing that, a decent strategy for any large tech firm is the ‘woke’ one, focus on emotive and important issues early, such as facial recognition. So that we don’t ask the really hard questions.

My 2 cents;

More than ever before governments should become “we, the people”.