Big tech companies —Alphabet (Google), Amazon, Apple, Meta, Microsoft, and Nvidia— are on track to earn more than $1.65T in aggregate revenue this year. The group has already notched over $200B in profits in 2023.

Origen: The future of big tech in 10 charts – CB Insights Research

1. TAMAÑO

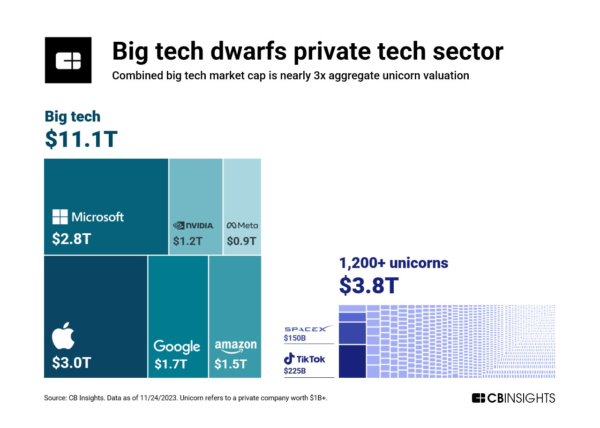

The 6 tech giants hold an aggregate valuation of over $11T — nearly 3 times that of the entire billion-dollar unicorn club.

Even the largest unicorns are unlikely to be big tech contenders any time soon.

2. MIEMBROS

Alphabet (Google), Amazon, Apple, Meta, Microsoft, Nvidia & Tesla

3. INGRESOS

growth is slowing as they get bigger. To fuel growth moving forward, they’ll be looking to reach into new markets, while staying at the cutting edge of emerging technologies like generative AI, quantum, and AR/VR.

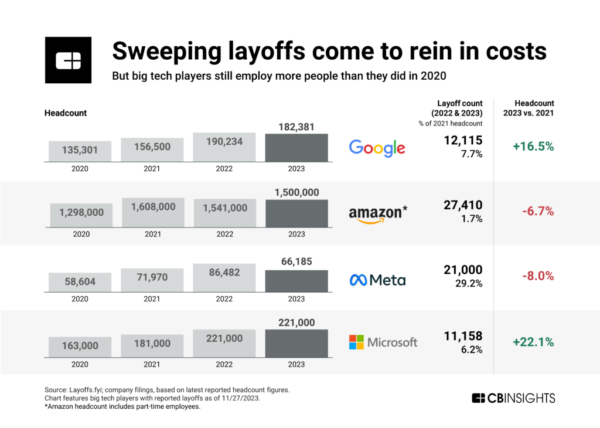

4. EMPLEO Y COSTES (EFICIENCIA)

Though they still employ far more people now than they did in 2020, the pace of hiring will likely remain slower, with a focus on keeping expenses in check.

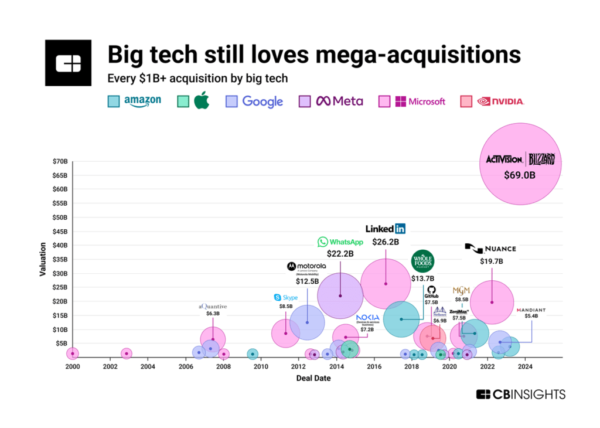

5. FUSIONES Y ADQUISICIONES & 6. CONTROL DE COMPETENCIA

Large acquisitions have historically been key for big tech to bring in new revenue sources as well as launch new product lines. But regulatory pressure has put a damper on this activity…

In the meantime, expect smaller deals from these players going after key tech capabilities or talent.

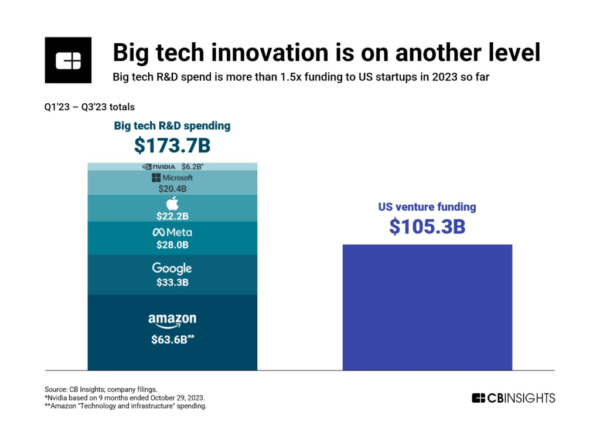

7. GASTO EN I+D

In the US, big tech companies’ R&D investment outpaces that of overall US venture funding by a wide margin.

8. TODO A LA IA

Tech giants are throwing their weight behind promising AI startups, offering computing power and funds for development, especially in the realm of generative AI.

9. COMPETENCIA EN TERRITORIO AJENO

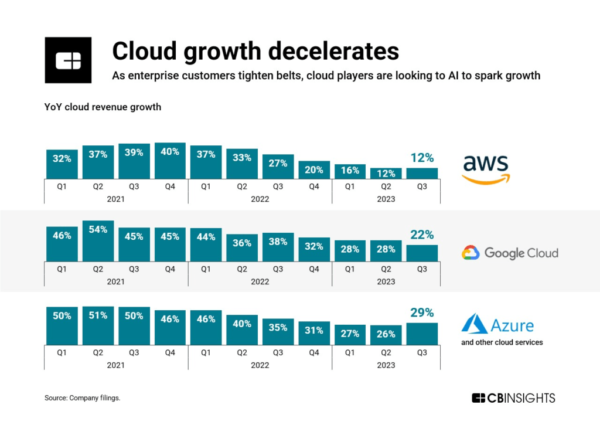

Big tech’s revenue sources are increasingly overlapping. Cloud computing revenue growth, for example, has slowed…

Amazon, Microsoft, and Google are looking to compute-hungry AI to fuel their cloud computing businesses. Meanwhile, Amazon is continuing to gain share from leaders Google and Meta in the digital advertising realm.