12 Industries Experts Say Millennials Are Killing — And Why They’re Wrong – CB Insights Research

What’s really ‘killing’ these industries

Industries are not being threatened by millennials themselves. The threat comes from younger, more adaptive brands that have zeroed in on millennial habits and preferences, and are actively leveraging those insights to unlock huge market potential.

The message from millennials is clear: brands that prioritize convenience, personalization, and sustainability will thrive. Brands that continue to cling to outmoded ideas of consumer behavior will continue to struggle.

A number of industries have already figured this out. For example, the $3.7B wellness economy, which spans everything from fitness and athleisure to mental wellness and personal care, is thriving thanks to young consumers. Pet care, coffee, snacks, and live entertainment are also successfully connecting with millennial shoppers.

Industry disruption was happening long before millennials came along, and it will continue long after. The brands that manage to survive changes in consumer preferences are the ones that listen, adapt, and realize that shifting markets are not a threat, but an opportunity for creative transformation.

1. Cereal

The breakfast food that’s too “inconvenient” for millennials may actually just be too sugary

The question that cereal brands should be asking is not, “How do we make millennials eat cereal for breakfast?” Instead, it’s “How can we make cereal a more appealing snack?”

2. Casual dining

Millennials eat out more than any other generation — they just don’t want to sit in booths

By offering more dine-and-dash convenience, revising menus to highlight more health-conscious fare, and even reimagining spaces to better align with contemporary design sensibilities, former dining heavyweights could reclaim some of their market share from the fast casual invaders.

3. Department stores

Millennials aren’t turning their backs on brick-and-mortar, but traditional departments stores are pricey and have limited selection

If department stores can tap into millennials’ hunger for experience and convenience, and address theiçr concerns about cost and ethical consumption, they could still draw younger shoppers back in.

4. Luxury goods

Millennials like luxury, but they rent more and buy less

The clothing rental model has struck a chord among millennials, likely because of its emphasis on flexibility. 17% of millennials have rented clothing or accessories, according to a recent survey by Price Intelligently.

Moving foward, the rental model could pose a challenge to traditional luxury brands unwilling to adapt. But, as the success of LVMH and Tapestry illustrate, there are opportunities for creative brands to claim their slice of the millennial pie.

5. Cable TV

Millennials are cutting the cord, but Gen X is more pro-streaming than any other generation

Premium cable channels like HBO and Showtime have introduced their own a la carte apps with pricing similar to Netflix or Hulu. If cable providers want to stem the tide of customers abandoning their services, they should consider doing the same.

6. Gyms

Solo exercise is out and group classes are in for the “lonely generation”

As with the shifts in many other industries, the idea that millennials are actively “killing” gyms doesn’t hold up. Rather, millennials are willing to pay a premium for fitness experiences that fulfill their desire for flexibility and community — and the fitness industry should take note.

7. American cheese

Millennials aren’t turning against cheese, they’re avoiding fake, processed foods

Fast-food outlets are jumping on the trend, switching to cheddar, Gouda, and other cheeses in their sandwiches and burgers. This includes Panera, Wendy’s, and even McDonald’s, which now sells Big Macs with a non-artificial cheese.

8. Beer

Craft beer is on the rise, while mass market beers are losing popularity

The adoption of craft sensibilities appears to have served the beer giants well, with Anheuser-Busch reporting 16.8% combined global brand revenue growth in 2017.

The beer industry illustrates another instance in which the key to successfully navigating shifts in consumer preferences is not to change millennials — but to change with them.

9. Canned tuna

Millennials like tuna, but they prefer it outside of the can

Poke bars embody everything millennials appreciate: a fast, fresh, protein-rich, relatively inexpensive meal served in a bowl. It can be made with salmon or other fish, but tuna is the most popular base.

Evidence suggests that some of canned tuna’s difficulties may be of the industry’s own making. One possible culprit: the well-publicized issue of dolphins getting caught in tuna nets, which clashes with millennials’ concern about sustainable food practices. …

To remain relevant to this generation of consumers, canned tuna brands will have to convince millennials that they are prioritizing ethical practices.

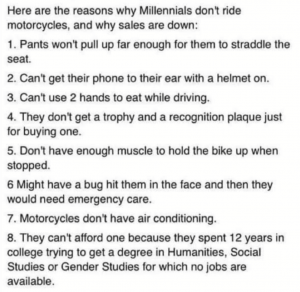

10. Motorcycles

The rising micromobility movement is making motorcycles smaller and better suited for millennials

Some players in the motorcycle industry are making efforts to adapt, shifting to smaller, lighter models. These bikes are easier for the first-time rider, more affordable, and better for urban riding — qualities tailor-made to appeal to millennial sensibilities. Between 2011 and 2016, sales of bikes with smaller engines increased by 11.8%, compared with a 7.4% gain for bigger, more powerful motorcycles.

In the motorcycle space, the secret to survival may be to think small.

11. Golf

The exclusive private country club is in decline for a generation more focused on inclusion

As with gyms, millennial golfers want customization and personalized service. Over half (51%) say they’d prefer a flexible membership combining a low social fee for full access to the club, with golf on a pay-per-use basis.

In short, golf will need to be more inclusive, affordable, and flexible if it wants to win over millennials and reverse the downward trend.

12. Raisins

Millennials want to avoid added sugar, even in a ‘healthier’ source

Some raisin industry leaders are doing exactly that. Sun-Maid, for example, is unveiling a new line of sour raisin snacks made with natural fruit juice and no added sugar in watermelon and strawberry flavors.

Healthy snacks represented a $23B opportunity worldwide in 2018. By expanding their selection of natural fruit snacks, it appears Sun-Maid is working to claim a slice of that pie.